Hi {{first_name|nurse,}}

When COVID first struck the United States in 2020, Monica and I still faced $128,000 in debt.

That included the remaining balance on a $70,000 personal loan for our house down payment, the loan for our new $76,000 Volvo, and about $20,000 in student loans. We didn’t even have a single dollar of savings.

At the same time, our friends at Stanford had their pay slashed by 30% overnight. If our employer decided to do the same, or if layoffs started at our hospital, we would have been in serious trouble with no safety net.

Overtime Was the Only Option

As soon as OT opened up, we took it.

In one two-week stretch, I worked close to 90 hours of overtime and grossed $11,361. Monica stacked night differentials and premiums until her check came to $8,197.

Together, we made nearly $20,000 in a two-week period. Every dollar went toward debt.

Within one year, we paid off the full $128,000 balance.

Why Overtime Keeps Nurses Broke

For most nurses, OT isn’t a wealth-building plan. It keeps you stuck in constant survival mode.

A large portion of OT pay disappears into taxes. Bigger paychecks lead to new bills, new car payments, eating out more often. Once those bills are fixed, you depend on OT to keep up.

When overtime dries up, the payments don’t. That’s how nurses earning $200K still live paycheck to paycheck.

Overtime works only when it’s used aggressively, for a short period, to eliminate debt or invest wisely. But as a long-term plan, it guarantees you’ll stay stuck.

California Changed the Math

This never would have worked for us in New York. Rent and taxes swallowed every pay check, and unsafe ratios made the extra hours unbearable.

Sacramento was different.

My starting pay was $65/hr. Monica’s was over $77/hr.

Our home cost $697,000. In the Bay, the same house would have been over $1.2 million.

California’s nurse-to-patient ratios allowed us to pick up extra shifts without dangerous assignments.

High pay. Safer staffing. More reasonable housing. That combination gave us the leverage we couldn’t get while living and working in NYC.

Where We Stand in 2025

We no longer rely on overtime to survive.

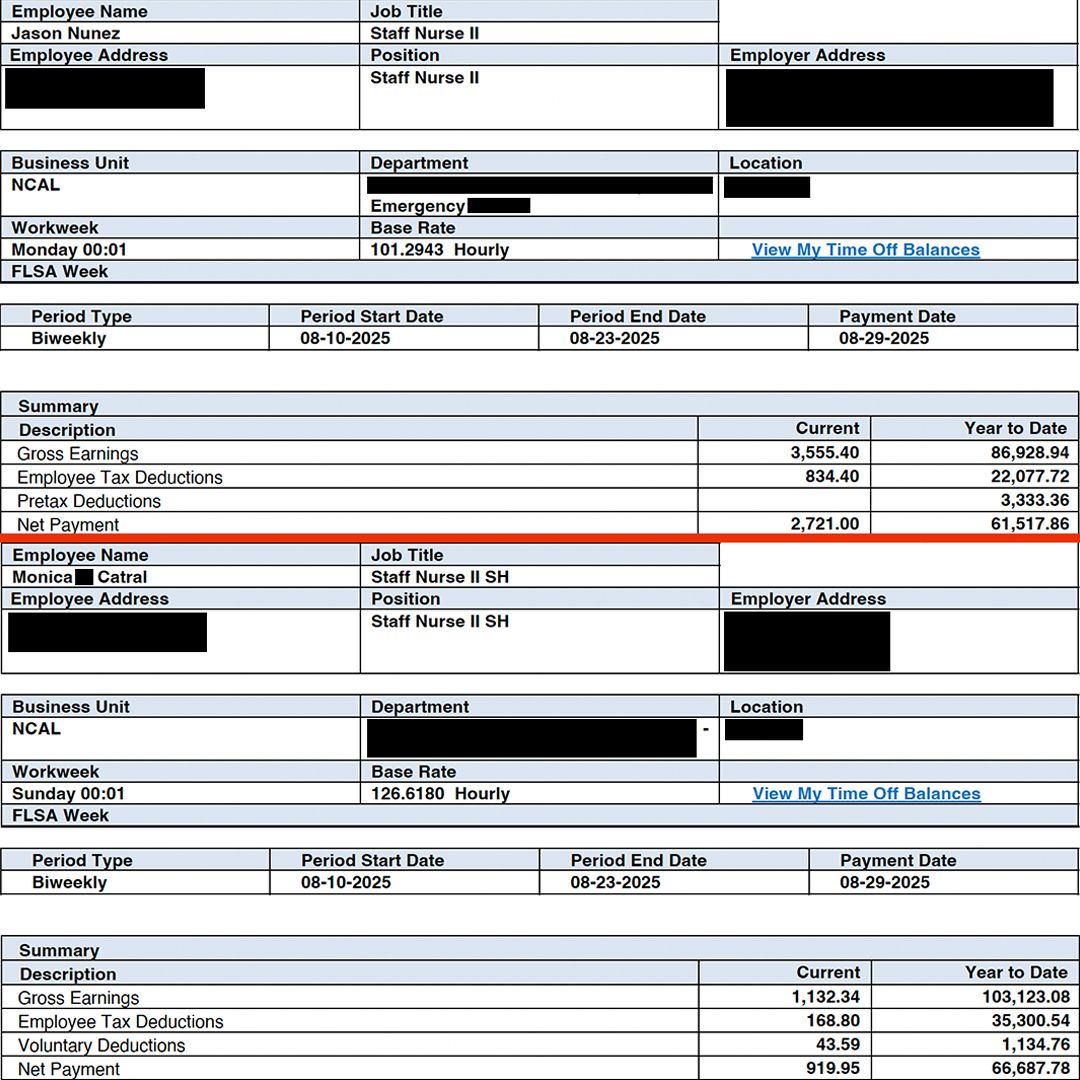

Jason & Monica Pay Through August 23, 2025

Based on paystubs through 8/23/2025:

I’ve grossed $86,929 year-to-date, on track for ~$135,000 gross / ~$95,500 net.

Monica has grossed $103,123 year-to-date, on track for ~$160,000 gross / ~$103,500 net.

Combined: just under $300,000 gross and $200,000 net for the year.

And that’s on part-time hours:

I average ~20 hours per week at $151/hr including differentials and holiday pay.

Monica averages ~23 hours per week at ~$158/hr with per diem, night diff, and some OT (overtime) and DT (double time) pay.

The Key Point

Overtime was the tool that wiped out $128,000 of our debt in one year. But it was never our long-term plan to keep working an excess number of hours.

If your bills depend on OT, you’re broke.

Use it as a reset button, not a lifestyle. Pay off what you owe, then step back and build a system where your regular income covers everything and leaves room to save.

Don’t live on OT. Build wealth instead.

Jason

Do you want to make more as a nurse?

I built the Nurses to Riches Accelerator to help you:

Relocate to Northern California the smart way

Secure a high-paying hospital job (we’re talking $200K+ a year)

Learn to calculate your real take-home pay

Work fewer hours—without sacrificing income

Start investing + paying off debt like a boss

I’ll even show you how to compare hospitals, filter by pay and shift type, and fast-track your move so you’re not spinning your wheels for another year.

Use code LOYALTY10 for 10% off the program

Weekly Update:

Watch our latest YouTube videos:

Download our app — Map My Pay so you can compare nurse salaries and cost of living data across over 1000 US cities.