Monica and I have been nurses since 2012 and 2013, but honestly, we didn’t take our finances seriously until we made the decision to move here. Before that? Our spending was out of control.

By the time we got to California, we had $80,000 in student loan debt, slapped another $25,000 on credit cards to cover the move, had a shiny new $76,000 Volvo XC90 (because apparently, we thought we were living large), and—if that wasn’t enough—we took out a $70,000 loan for the down payment on our house.

Yeah… we were nuts!

But the good news is we learned from our mistakes, and we started documenting our journey on YouTube to help others avoid the same financial mess we got ourselves into.

When we first graduated from nursing school, our net worth was a solid negative $80,000. Then, thanks to that whirlwind of spending, it ballooned to negative $200,000 after we bought our house.

And then… COVID hit.

That’s when things really changed for us.

Or, should I say, that’s when Monica decided we were done with this debt-ridden lifestyle. She had enough of feeling as if we were constantly behind, so we buckled down, and this time for real.

The truth is, I’ve always been the entrepreneurial type, always had dreams of becoming a millionaire in my 20s. I was always the one who wanted to put our travels aside and invest every penny we earned.

But hey, marriage is all about compromise, right?

The compromise was this: we pay off our debts, save, and invest like crazy, and THEN we could enjoy the fruits of our labor without feeling like we were drowning.

So, fast forward four years since COVID rocked the world, and we’ve turned our finances around.

Our net worth now sits at a solid $753,405.

We recently shared a post on Instagram about our net worth journey, from our early days as new grad nurses to where we are today. Naturally, the comments section lit up with people asking why our net worth isn’t higher than it is.

But here’s the truth: we’ve actually increased our net worth by over $900,000 when you factor in all the debt we’ve paid off over the years.

So, how far behind are we, really, when you look at the big picture and the stats?

Our average w2 income is $13,350.79 per month as of the end of August.

According to the Federal Reserve’s Survey of Consumer Finances—and as reported by CNBC—our median net worth at age 30 should be around $135,600, with the average net worth coming in at $549,600 (though the average is heavily skewed by the wealthiest households).

It’s easy to scroll through social media and feel like no matter how much progress you make, it’s never enough. Monica and I have been there too. But after we paid off over $128,000 in consumer debt in under a year (excluding our mortgage), we made a decision: no more overworking ourselves.

Honestly, we do feel like we’ve made it. Our average W-2 income as of the end of August is $13,350.79 per month.

You might be wondering why our income seems low—especially considering it’s the least we’ve made at our jobs since 2017, back when we were still working as nurses in NYC.

And no, it’s not because our hourly rate has gone down. Before leaving NYC, we were making about $50/hr. Fast forward to today, I’m earning $103/hr as an ER staff nurse, and Monica pulls in $133/hr as a per diem nurse on a tele unit.

So, why has our income dropped?

The truth is, after we paid off our debt and had our son, burnout hit us hard. Our income dropped by 24% from our peak in 2019, even though we were only working 26 to 30 hours a week back then. Most of those hours were grueling—multiple 12- and 16-hour shifts in a row.

After feeling completely overworked, we made a conscious decision to cut back. Now, between the two of us, we’re averaging no more than 32.64 hours a week combined.

Monica, in particular, has scaled back significantly—she’s averaging just 15.36 hours of work per week.

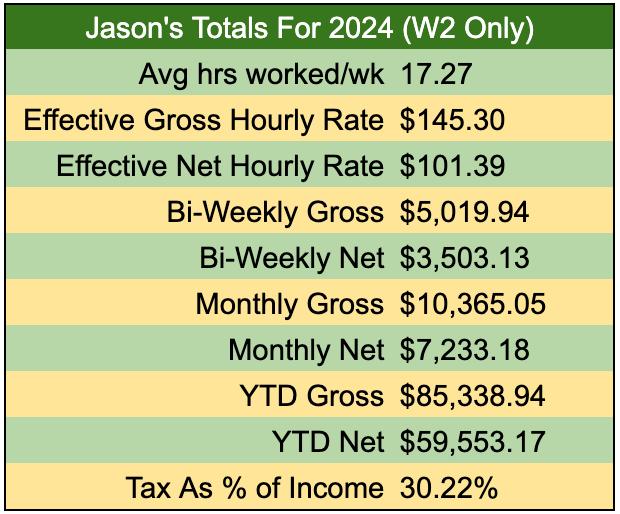

And I average 17.27 hours per week.

When I look at these numbers, I genuinely believe we’re doing great. We're working fewer hours than the average nurse and still bringing in over $13,000 per month.

On top of that, we've significantly increased our business income, which has given us even more financial flexibility.

We launched our YouTube channel in 2021, and that same year, we made a conscious decision to shift our focus toward building a business-driven income.

Since then, our business income has consistently tripled every year.

This year alone, we’re averaging $7,242 per month from our business.

When you combine that with our W2 income, our total monthly net income comes out to around $15,714, even after accounting for taxes on both.

If we keep this momentum going, I can easily see our net worth growing at a pace that wouldn’t have been possible if we just stuck to picking up extra shifts at our nursing jobs.

What do you think?

See you soon!

— Jason

If you appreciate the transparency in this newsletter, we share more of this with our members in the Nurses to Riches accelerator program.

The program was created for nurses who want to move to California and earn $200,000 per year while working fewer than 40 hours per week (you can actually do it while working 32 hours per week if you follow our plan).

It teaches you:

Whether California is (or isn’t) for you

How to get licensed in California

How to plan before you move

How to find a hospital that makes sense for you

How to analyze and determine your wage on a hospital-by-hospital basis by using our Top California Hospitals Spreadsheet

How to determine which city makes the most sense to live in by using our Ultimate Salaries Spreadsheet with Cost of Living data

How to work smarter, not harder so you can reduce your working hours and make more money

How to get rid of your debt (we paid off $128k in less than 1 year)

How to begin to invest your money

If this sounds good to you, you can visit our website and use coupon code “LOYAL5” to get an additional 5% off the already heavily discounted 50% off until we increase our prices as a thank you for being a subscriber of our newsletter.