Sup nurses!

I want to share a personal story that I believe can help many of you make wiser financial decisions and it's about our experience with buying a luxury car.

You see, a few years ago, while living in NYC, we were broke and living it up.

We thought we were doing well for ourselves and we wanted the world to know about it.

So, in 2017, we bought a brand new Volvo XC90 for $76,000.

We paid it off quickly because we wanted to be debt-free.

When we first purchased it, it felt like a great decision. We thought we were investing in something that would bring us comfort and convenience—and best of all, we felt like we were riding in luxury.

However, the reality turned out to be quite different.

Over the past year, we’ve spent $6,529.43 on maintenance and car repairs. Yes, you read that right—$6,529.43! And this does not even include oil changes, the cost of gas, auto insurance, or the fact that the car has been depreciating in value since we drove it off the dealership.

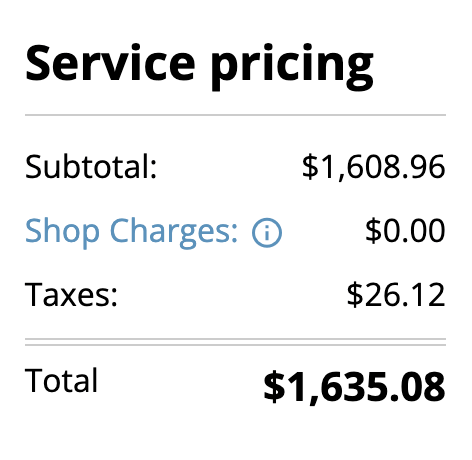

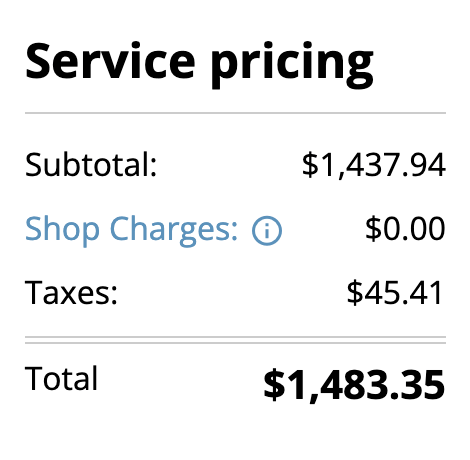

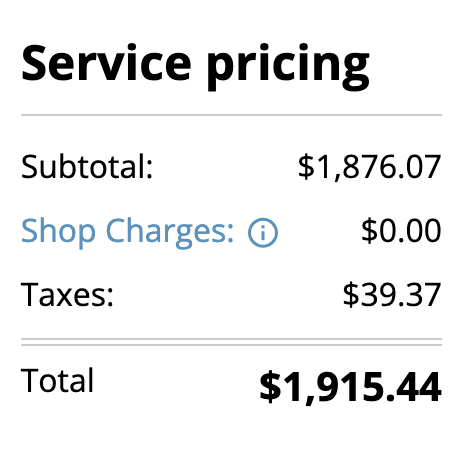

And if you don’t believe how much we’ve spent this past year, here are the receipts:

Coolant and heater hose leaks

Broken A/C system and break pads replacements

Coolant hose leak #2 and broken control arm

Replacement cost for 4 tires

As you can see, this was a huge waste of our finances and a wake-up call.

Luxury cars may look nice and feel great to drive, but they come with hefty maintenance costs.

We learned the hard way that luxury cars are not an investment. Unlike real estate or stocks, cars depreciate in value. They lose value the moment you drive them off the lot and continue to lose value every year. Plus, the maintenance costs are often much higher than those of more affordable vehicles.

Had we invested the $76,000 in the S&P 500 instead of purchasing this car, that $76,000 would be worth $191,479.18 today—the thought of that makes me sick to my stomach.

S&P 500 returns from 2017 to 2024 on a $76,000 investment

To give you more perspective, here are some stories about extremely wealthy public figures who drive inexpensive cars:

Warren Buffett

Net Worth: Over $100 billion

Car: 2014 Cadillac XTS

Cost: Around $45,000

Percentage of Net Worth: 0.000045%

Mark Zuckerberg

Net Worth: Over $100 billion

Car: Honda Fit

Cost: Around $16,000

Percentage of Net Worth: 0.000016%

Ingvar Kamprad (founder of IKEA)

Net Worth: Over $50 billion

Car: 1993 Volvo 240

Cost: Around $1,500 (used)

Percentage of Net Worth: 0.000003%

Now, let's compare this to the average American:

Average American Annual Income: Approximately $70,000 (according to the U.S. Census Bureau)

Average Car Cost: Around $37,000 (according to Kelley Blue Book)

Percentage of Annual Income: 53%

These examples show that even the richest people in the world choose to drive modest cars. They understand that a car is a depreciating asset and prefer to invest their money in ways that will grow their wealth.

On the other hand, the average American spends a lot more of their annual income on their car. These stats are insane...

As nurses, you work hard for your money. Don’t you?

It's important to spend it wisely and invest in things that will bring you long-term value.

Instead of splurging on a luxury car, consider more affordable and reliable options. Our next car purchase is going to go toward a used car that we can either afford to pay in full or in less than 1 year.

In our videos and newsletter, we always emphasize making smart financial decisions. This includes choosing where to live and work so you can maximize your income and increase your savings and investment rate.

Speaking of which, if you haven't checked out our spreadsheets yet, now is a great time! They can help you find the best-paying nursing jobs in Northern California and compare salaries and living costs across the US.

Remember, our goal is to help all nurses achieve financial freedom and make better financial decisions.

We’ve learned from our mistakes, and we want to share those lessons with you.

Stay safe, and as always, thank you for all the hard work you do.

If you find value in our newsletters, I would really appreciate it if you could share it with your friends. Forward this email to them or let them know about us.

See you soon!

Jason

P.S. We will continue to give our newsletter subscribers a 20% discount on every spreadsheet on our website with the coupon code “20HOURS”. Get yours now!

What is your profession?

😃 Weekly Update:

📺️ Watch our latest YouTube videos: