Sup nurses!

If you follow any nurses on social media, you may have seen them posting videos about their lavish and luxurious vacations.

I've always wondered what their financial situation looks like and how much of their vacation is going on a credit card.

That's why Monica and I have always strived to be as transparent as possible.

In 2022, we traveled to over six destinations, spending more than $70,000 and investing over $80,000.

In the same year, we were netting around $15,770 per month, while each of us worked 20 to 22 hours per week.

But let's fast forward a few years. After having our son in 2021, we realized we were spending less time with him than we would have preferred.

So, in 2023, we stopped picking up as much overtime as we had in the previous years. This meant no more double time, no more runs, and (at least for me) no more overtime at all.

It's been nearly two years since we made the decision to stop picking up overtime, and now I still get my nice days off in a row, and Monica gets eleven days off in a row every other week.

We're living life to the fullest!

But it did come at a sacrifice. Because of this decision to not work overtime, our income has suffered as a result (or has it?).

Our average monthly W2 income is $12,857.01, and we're OK with that because each of us is only working an average of 16.11 hours per week.

So much so, that in February we decided to book our first international vacation since the summer of 2023.

We will be traveling to Bora Bora—a place that has been on our bucket list since before we became nurses.

This trip is going to cost us more than most people spend on vacations in a couple of years.

ep… $16,039.06.

And this is before we even get to the destination.

I am anticipating this trip will cost us at least $20,000.

So, why aren't we worried about it?

Well, for one, we've been putting money into our savings account for at least six months in preparation for this trip.

When we made the $16,039.06 payment, we used our credit card and immediately paid it off with the money we had in our high-yield savings account. So, in essence, we earned around $300 in points for booking this trip with our credit card and another $330 for keeping the money in our high-yield savings account.

Secondly, our business income.

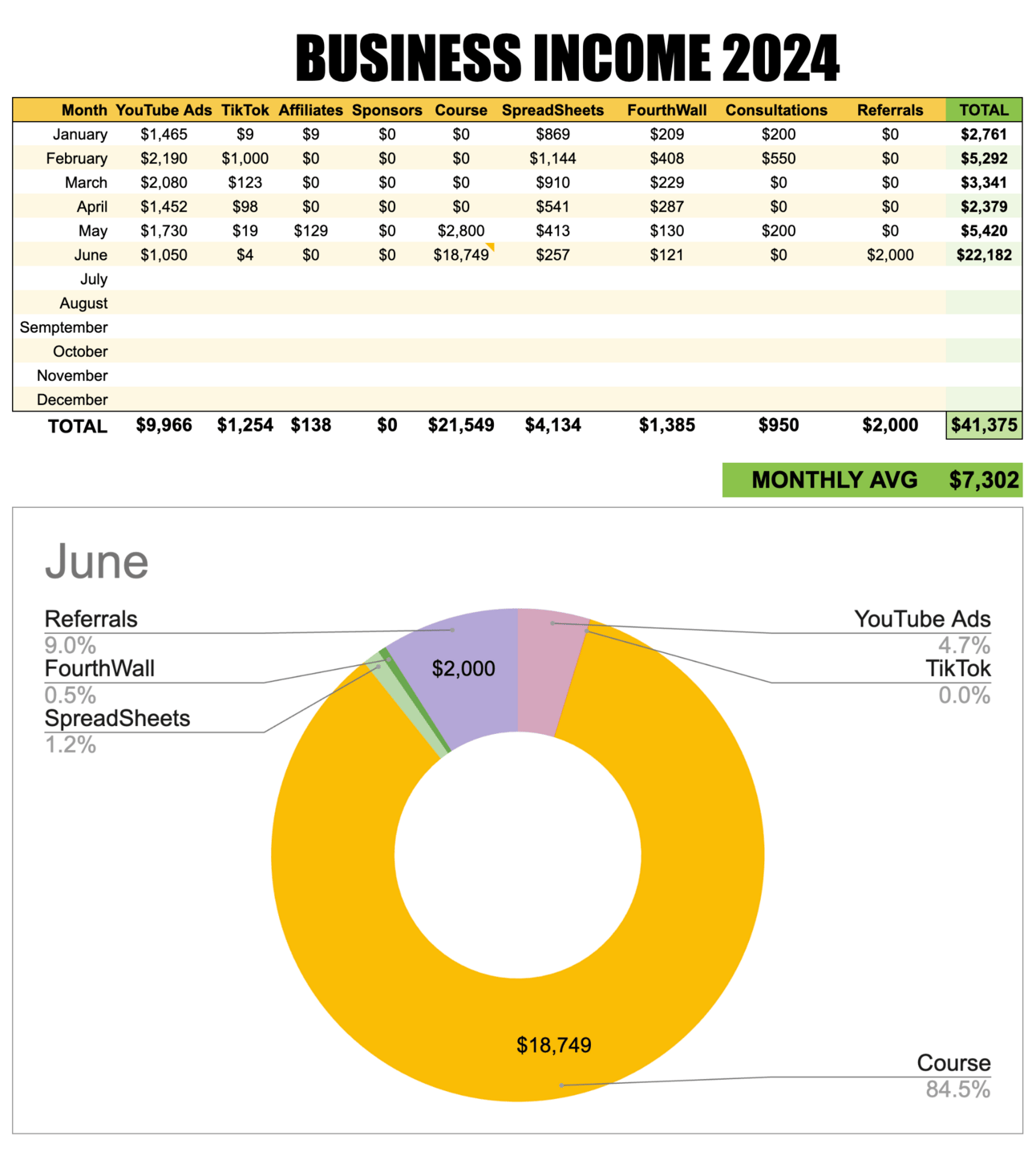

Our average monthly revenue from our business as of June 20, 2024, is $7,302. In fact, from late March to mid-June, we have generated over $27,000—more than half of what we earned since the beginning of the year.

Between our W2 jobs and business, we've managed to gross an average of $27,772.55 and have an estimated net income of $19,415.99 per month.

Our monthly personal expenses are around $11,833.93. Before we had our son, they hovered around $8,500, but we decided to enroll him in preschool to help with his socialization skills and to give us more time to work on the business.

A few years ago, when we were working more hours per week and netting $16,000 to $18,000 per month, we still had plenty of personal income for vacations and investments.

But, as you can see now, our personal expenses have increased. Our working hours have decreased, and we had to make up for that by increasing our business income.

So, today we spend an average of $14,658.83 per month in personal and business expenses. After deducting that from the $19,415.99 we bring in, we net about $4,757.16.

The goal is to continue to widen the gap between our revenue and our expenses.

We will continue to hold off on the several vacations and $70,000+ we used to spend prior to 2023 and instead focus on growing our business income.

I do think we are on the right track because our business income has either doubled or tripled year over year since we started our YouTube channel in 2021.

If you appreciate the transparency in this newsletter, we share more of this with our members in the Nurses to Riches accelerator program.

The program was created for nurses who want to move to California and earn $200,000 per year while working fewer than 40 hours per week.

It teaches you:

Whether California is (or isn’t) for you

How to get licensed in California

How to plan before you move

How to find a hospital that makes sense for you

How to analyze and determine your wage on a hospital-by-hospital basis by using our Top California Hospitals Spreadsheet

How to determine which city makes the most sense to live in by using our Ultimate Salaries Spreadsheet with Cost of Living data

How to work smarter, not harder so you can reduce your working hours and make more money

How to get rid of your debt (we paid off $128k in less than 1 year)

How to begin to invest your money

If this sounds good to you and you want to be part of our community, you can visit our website and use coupon code “LOYAL5” to get an additional 5% off the already heavily discounted 50% from the original price as a thank you for being a subscriber of our newsletter.