Every Nurse Has Asked It: “Where’s My Money Going?”

You pick up extra shifts. You skip lunches. You say yes when charge nurses ask you to stay late.

But somehow, when your paycheck hits, it still feels like there’s a hole in the bucket.

You’re not imagining it.

Most nurses have no idea what’s actually eating their income — because hospitals and payroll systems don’t show the full breakdown of taxes, deductions, and real take-home pay.

That’s one of the main reasons Monica and I built these spreadsheets in the first place.

Why We Built This Spreadsheet

When we first started comparing wages across California hospitals, we realized nurses were flying blind.

Hospitals post “average” salaries, job sites give made-up numbers, and you end up guessing whether a job is actually worth it.

So we started pulling real union contracts, one by one, and logging the exact pay scale for each facility — from base day shift all the way to per diem night shift.

Now we’ve updated it again for 2025 — and this time, it’s our most complete version yet.

New Hospitals Added

This update includes three major systems nurses have been asking about:

✅ Good Samaritan Hospital

✅ John Muir Health

✅ El Camino Hospital (updated 2025 pay scale)

These join over 60 hospitals already in our California database — all filterable by years of experience, shift type, and position (staff, per diem, etc.).

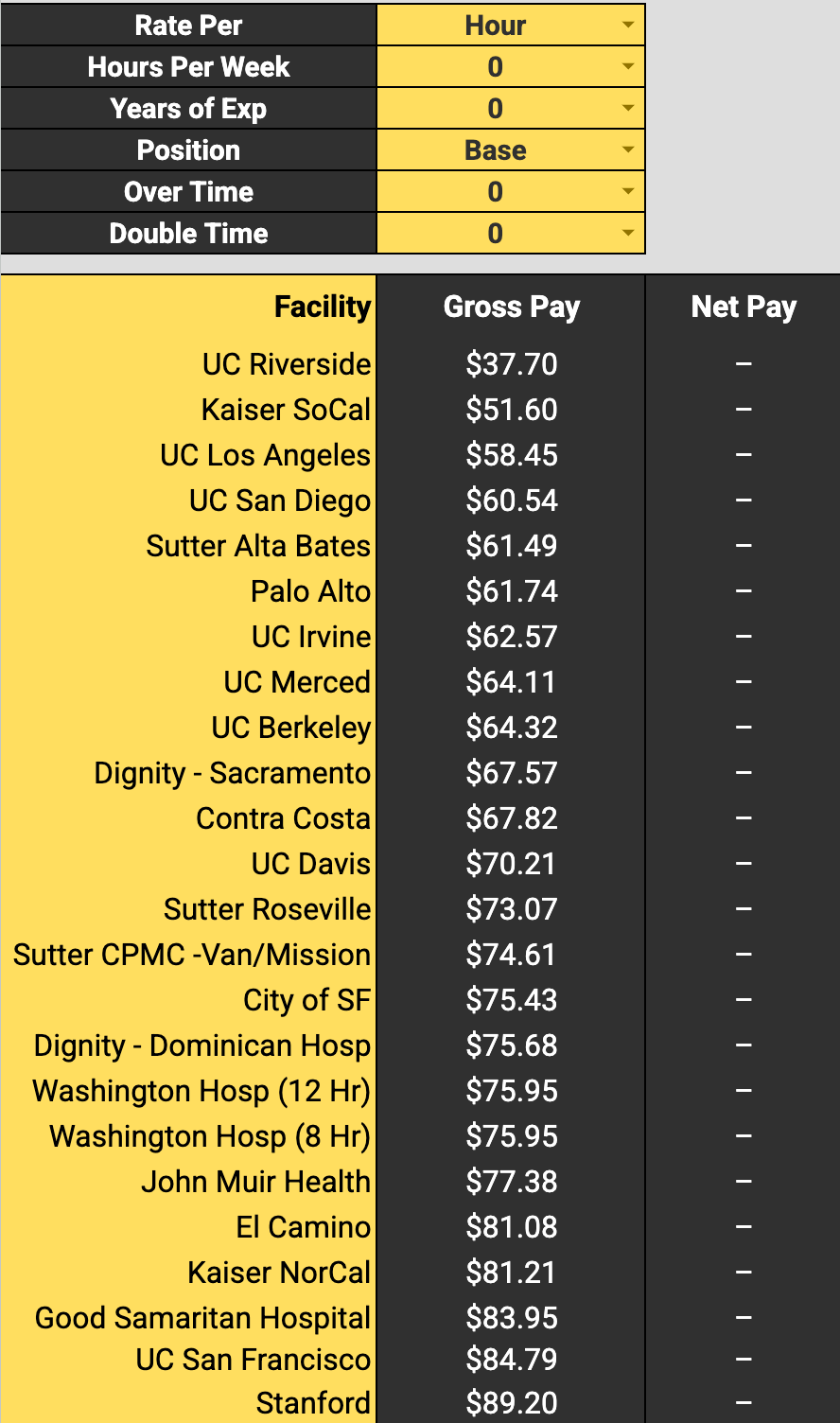

How High the Pay Really Goes (New-Grad Base Pay)

Here’s what base pay for new grads (0 years, days, no differentials) currently looks like:

New Grad Rates In Highest-Paying California Facilities

This is before any evening, night, weekend, or per diem differentials — which means the top-end hospitals can hit $130K+ annual base for new grads and climb past $300K for senior per diem nurses with differentials.

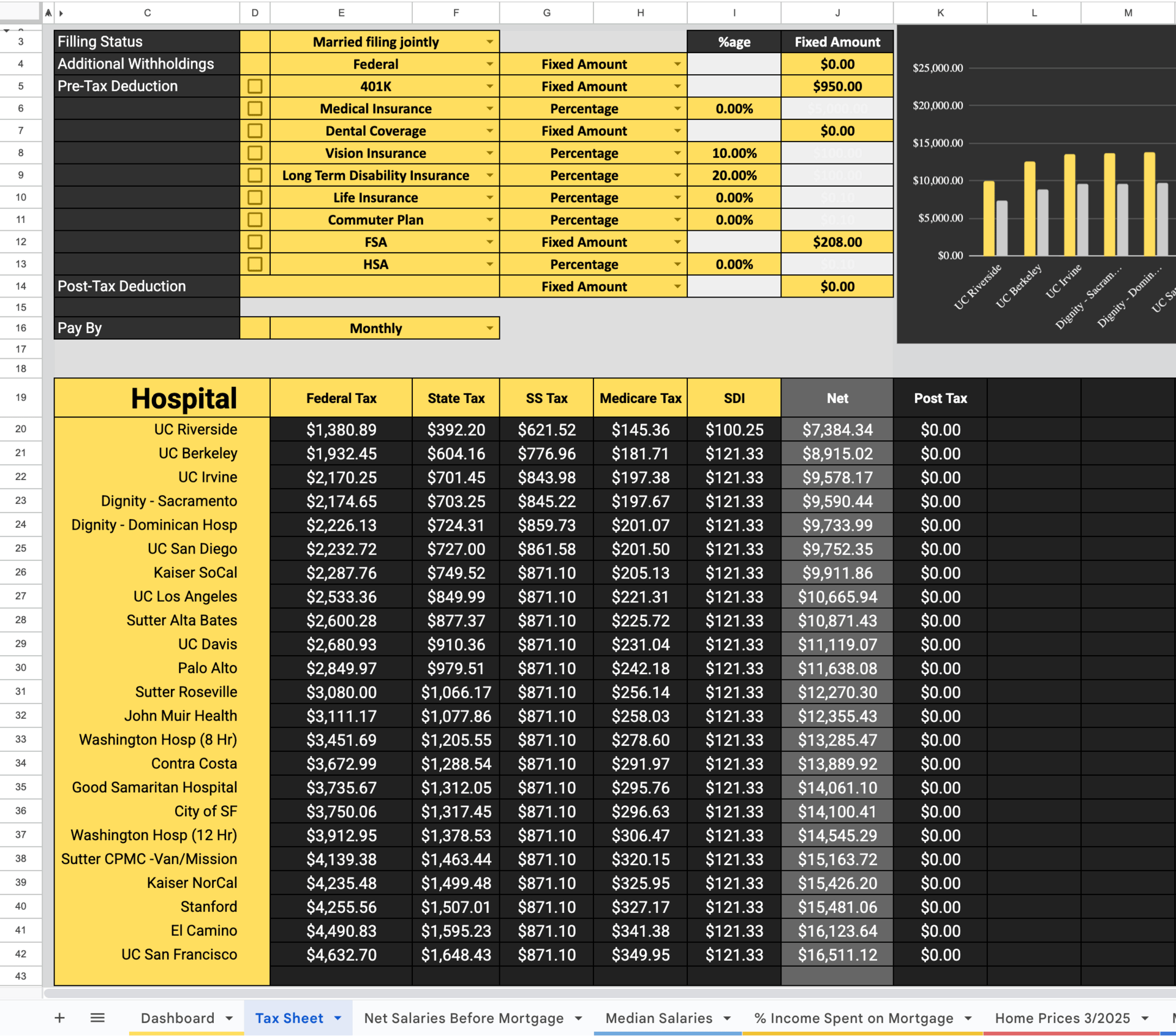

Most nurses underestimate how much taxes and deductions change their true take-home pay.

That’s why we built the Tax Sheet — a companion tab in the spreadsheet that does what your hospital payroll system doesn’t:

California Wage Tax Sheet

It lets you see exactly what comes out of your paycheck.

You can enter your:

Filing status (Single, Married, etc.)

401K contributions

Health, dental, and vision premiums

FSA and HSA deductions

Federal, state, SS, Medicare, and SDI rates

And it instantly calculates your net income after taxes — down to the dollar.

So instead of guessing what a “$180K job” actually pays, you’ll see your real monthly take-home, your tax split, and how much you keep if you increase 401K or switch filing status.

It even lets you toggle between monthly or biweekly pay, making it one of the most accurate paycheck estimators available for nurses.

This is how nurses in our program plan their year — by knowing what they actually keep instead of what looks good on paper.

The Oregon Update (Pro & VIP Exclusive)

We just released the Top Oregon Hospital Salaries Spreadsheet, exclusive to Pro and VIP members.

Here’s a preview of what’s inside:

Top Oregon Hospital Salaries For Nurses

Oregon may not match California’s top-end pay, but the cost of living and tax difference can flip the equation.

That’s why we added an Oregon-specific Tax Sheet that accounts for:

See Your Gross and Net Side by Side

Oregon’s flat 9% income tax

No state disability insurance (unlike CA)

Lower payroll tax burden

Fine-tune your deductions

With one click, you’ll see what your real net pay looks like in Oregon vs. California — and how much more freedom your money buys.

For Accelerator Members

If you’re part of the Nurses to Riches Accelerator, you now have access to:

✅ The updated Top California Hospitals Spreadsheet

✅ The Tax Sheet for accurate net-pay calculations

✅ (Pro & VIP) The Top Oregon Hospital Salaries Spreadsheet and Oregon Tax Sheet

Inside the course, we also show you how to:

Analyze pay across hospitals and states

Compare net income after taxes and housing

Plan relocations that increase yearly take-home by $50K–$100K

Strategically combine shifts, differentials, and benefits to maximize pay

For Non-Members

If you’re not a member yet, this update is your chance to see what’s possible.

Enroll today and use code LOYALTY10 for 10% off.

You’ll get:

✅ The complete Top California Hospitals Spreadsheet (with Good Samaritan, John Muir & El Camino added)

✅ The Tax Sheet for exact take-home pay

✅ (Pro & VIP only) The Top Oregon Hospital Salaries & Tax Sheet

✅ Lifetime access to the Accelerator course, teaching nurses how to earn $200K+ while working under 40 hours/week

Why This Matters

When Monica and I first started tracking our income, we realized we didn’t need to work more hours — we just needed to work smarter.

That meant understanding exactly how much we were keeping after taxes, housing, and benefits.

That knowledge changed everything for us.

It’s the same toolset that’s now helping other nurses plan moves, pay off debt, and finally stop living paycheck to paycheck.

If you want the data that changes everything, feel free to join the accelerator.

Jason

Nurses to Riches

@nursestoriches

Weekly Update:

Watch our latest YouTube videos:

Download our app — Map My Pay so you can compare nurse salaries and cost of living data across over 1000 US cities.